city of richmond property tax 2021

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

Municipal Court City Of Richmond

Personal Property taxes are billed annually with a due date of December 5 th.

. TAX YEAR 2021. Personal Property Registration Form. Rents or borrows tangible personal property that was used or available for use in a business and which was located in the city of richmond virginia on january 1 2021 to report such property on this return.

Ad Achieve Property Tax Compliance Avoid Penalties. Any outstanding property tax balance will be withdrawn on the tax due date from the. Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance Authority.

The second due date for an outstanding tax balance is September 2 2021. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. These documents are provided in Adobe Acrobat PDF format for printing.

Get In-Depth Property Tax Data In Minutes. Please read instructions on back before completing sections 12. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

The 10 late payment penalty is applied December 6 th. These agencies provide their required tax rates and the City collects the taxes on their behalf. Schedule a Free Consultation Today.

To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer. Start Your Homeowner Search Today. ELIGIBILITY REQUIREMENTS AND IMPORTANT INFORMATION.

You also have the option to go paperless and reduce clutter by eliminating your paper statement. See Property Records Tax Titles Owner Info More. Please keep this card for the 2021 season.

Tax notices were mailed out at the end of May but if you have not received your statement please call the City Tax department immediately at 604-276-4145. 295 with a minimum of 100. Real estate taxes are due on january 14th and june 14th each year.

COMPOST CARDS The City of Richmond Compost Cards is attached to the bottom of Richmond residents paid Ray County Real Estate Property Tax receipt. Macomb County Homestead Tax Rate Comparisons. Richmond property owners are reminded that property taxes are due on Friday July 2 2021.

3 Road Richmond British Columbia V6Y 2C1. The pre-payments will be applied to the annual flat rate utility bill due March 31 2021 and the balance applied to the property taxes due July 2 2021. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

Property Value 100 1000. Due Dates and Penalties for Property Tax. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. For Applicants Seeking Relief Because of Permanent and Total Disability.

Only property tax and parking tickets may be paid online. Electronic Check ACHEFT 095. 2021 Richmond Millage Rates.

Wric the city of richmond announced on monday that it has opened applications for its 2021 tax amnesty program. Search Any Address 2. 1000 x 120 tax rate 1200 real estate tax.

The City Assessor determines the FMV of over 70000 real property parcels each year. Ad Get Record Information From 2021 About Any County Property. This probably comes as no surprise but what does it mean for the City of Richmond.

Interest is assessed as of January 1 st at a rate of 10 per year. Property Taxes are due once a year in Richmond on the first business day of July. The applicant must be permanently and totally disabled as of December 31st of the.

City of Richmond Real Estate Search Program. FILING DEADLINE IS MARCH 31 2021. Searching Up-To-Date Property Records By County Just Got Easier.

Providing an Unrivaled Customer Experience for Over 20 Years. CITY OF RICHMOND VIRGINIA. You must complete this form in its entirety.

Richmond residents will have until July 2 to pay their property taxes without penalty. Friday July 2 2021. Within Richmond city limits a total of 3223 parcels constituting more than 8500 acres valued at some 74 billion are identified as tax exempt meaning they pay no property taxes at all.

Lets find out using the 2021 tax rolls. The City Hall cashier area has been reopened for tax and utility. Richmond property owners are reminded that property taxes are due on Friday July 2 2021.

RICHMOND MEMORY GARDENS UPDATE Maintenance and care of vases including turning them down are the responsibility of individuals. Tax notices were mailed out at the end of May but if you have not received your statement please call the City Tax department immediately at 604-276-4145. Richmonds property taxes due Friday July 2.

City of richmond counties of macomb and st. Emailed receipts provide electronic payment history without the paper. The City Hall cashier area has been reopened for tax and utility payments only.

By Richmond City Council. Personal Property Taxes are billed once a year with a December 5 th due date. Contact Us To Learn More.

APPLICATION FOR TAX RELIEF FOR ELDERLYDISABLED. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established. Yearly median tax in Richmond City.

The results of a successful search will provide the user with information including assessment details land data service. To view previous years Millage Rates for the City of Richmond please click here. Property value 100000.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. Personal Property Taxes.

Pin By Jeremy Green On Tattoos In 2021 Luxury Retreats Reading Loft Mansions Luxury

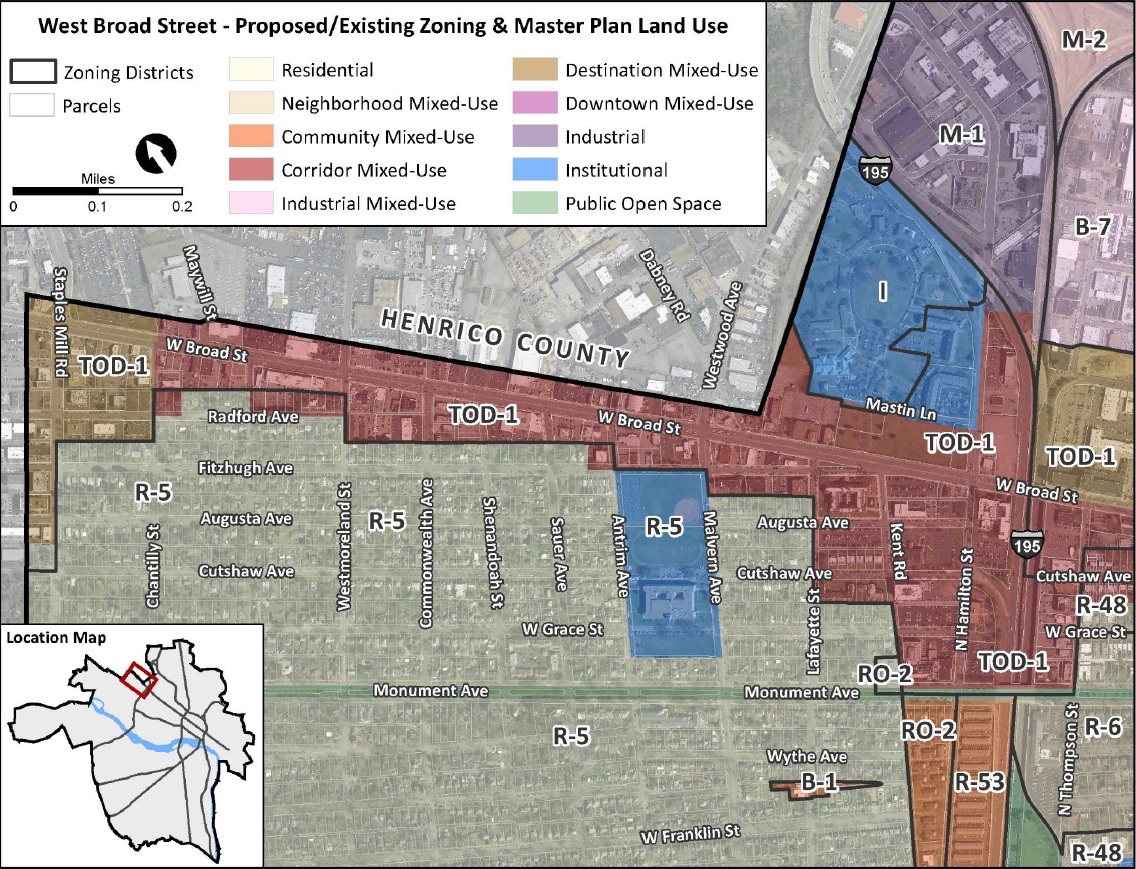

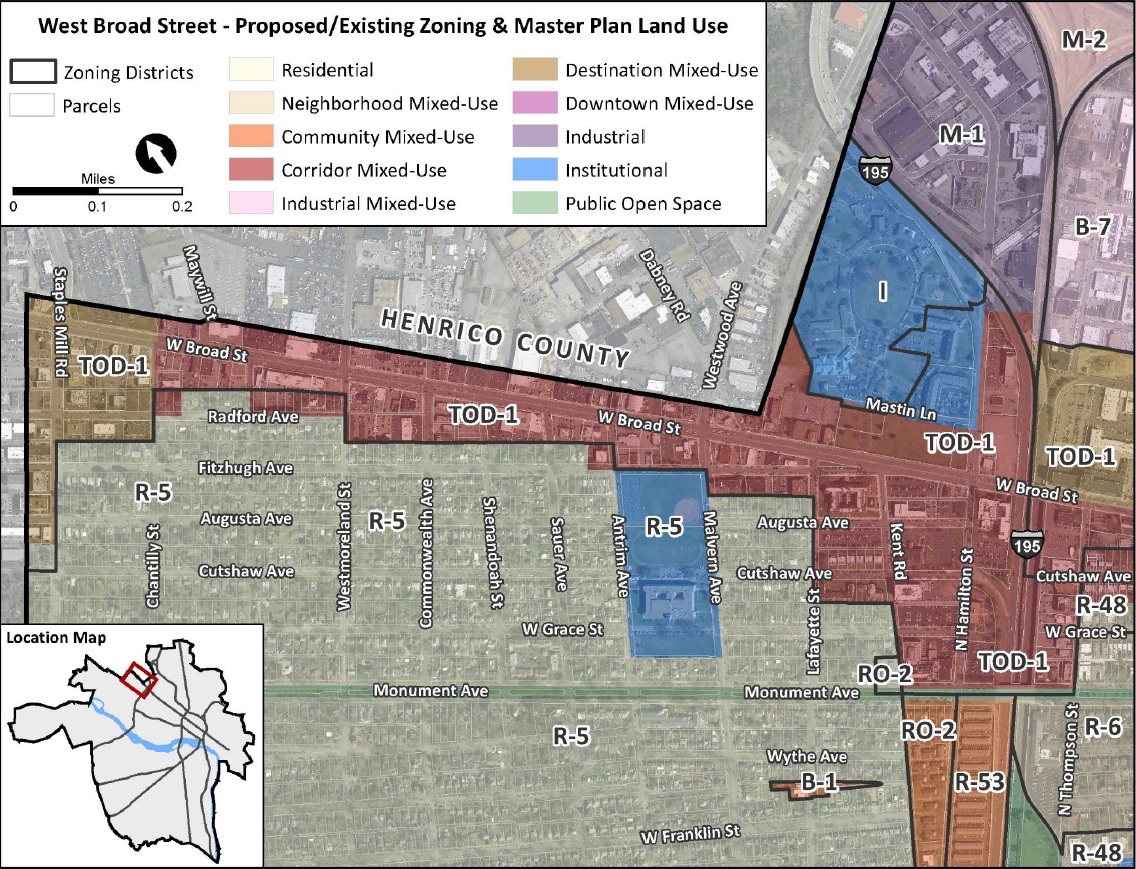

City Ponders Plan To Extend Tod Zoning Westward Along Broad Street Richmond Bizsense

Photo Images Of Richmond Virginia Richmond Virginia Richmond Va Places To Visit Richmond

Neighborhood Map For Lakes Of Bella Terra Located In Richmond Tx Presentation Layout Richmond Tx Urban Planning

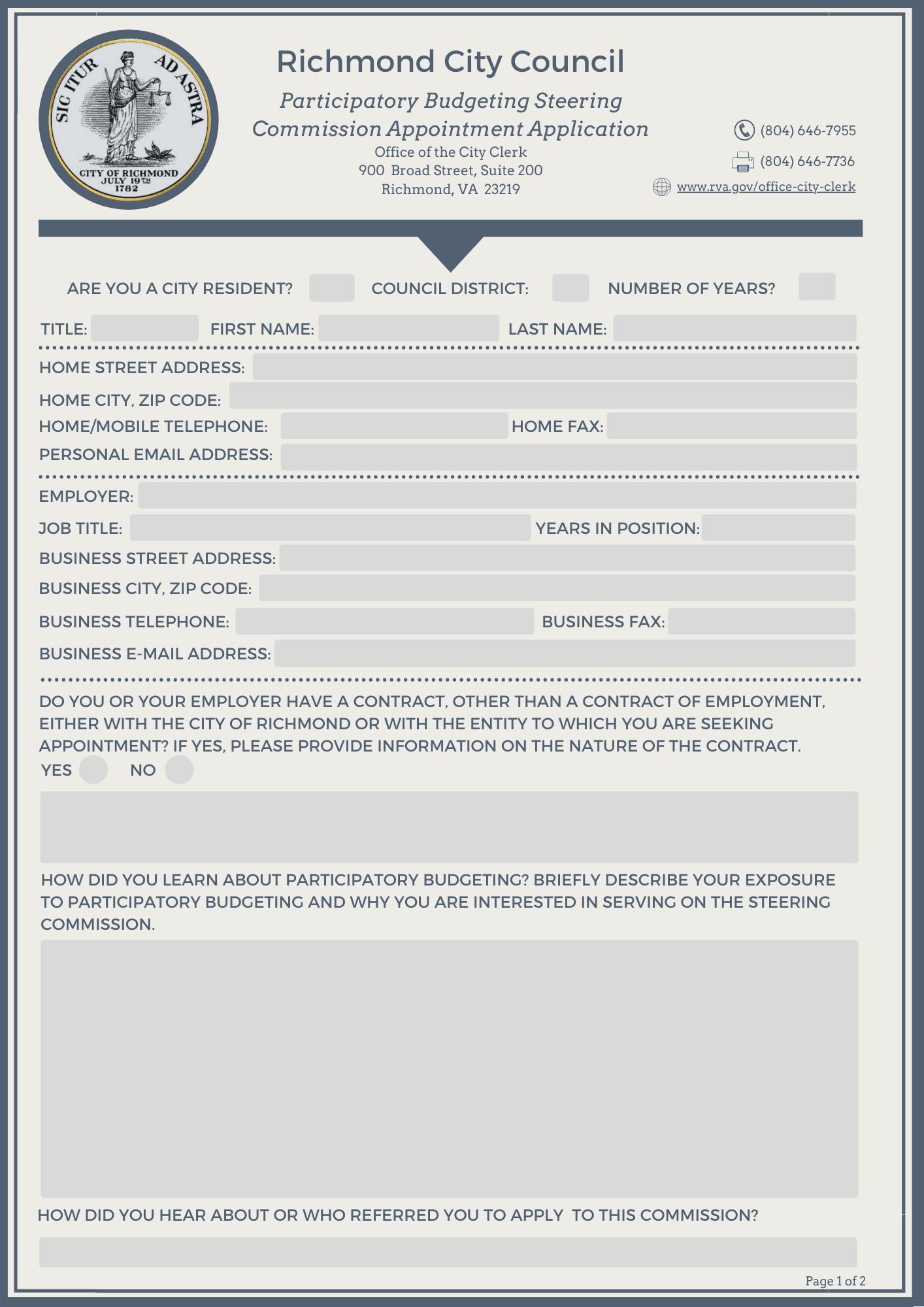

Boards And Commissions Richmond

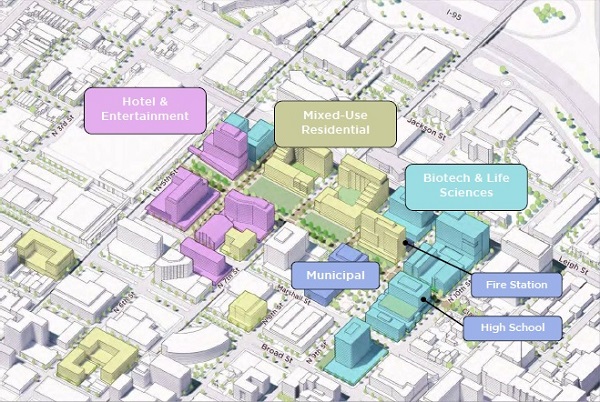

City S New City Center Plan Envisions Downtown Without The Coliseum Richmond Bizsense

Greencity Developers File Rezoning Request For 2 3b Project Richmond Bizsense